How Health Conditions Affect Home Insurance Eligibility

Exploring how health conditions impact home insurance eligibility opens up a world of possibilities and considerations. From pre-existing conditions to lifestyle choices, the landscape of insurance eligibility is vast and varied. Let’s delve into the intricate details of this crucial topic.

Detailing the factors that influence eligibility beyond health conditions and how individuals can navigate these waters is essential for anyone looking to secure home insurance.

How Health Conditions Affect Home Insurance Eligibility

When it comes to home insurance eligibility, the presence of certain health conditions can have a significant impact on the coverage options available to individuals. Insurance companies take into account various factors, including health conditions, to assess the level of risk associated with insuring a property.Common health conditions that may affect home insurance eligibility include:

Impact of Pre-existing Health Conditions

- Heart conditions

- Diabetes

- Cancer

- Respiratory conditions

Insurers assess these health conditions by considering the potential risks they pose to the insured property. For example, a person with a severe respiratory condition may be considered a higher risk for potential issues related to the home’s air quality or mold growth.

In such cases, insurers may adjust the coverage terms or premiums accordingly.It’s essential for individuals with pre-existing health conditions to disclose this information accurately when applying for home insurance to ensure they receive the appropriate coverage and avoid any potential complications in the future.

Factors Influencing Home Insurance Eligibility

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

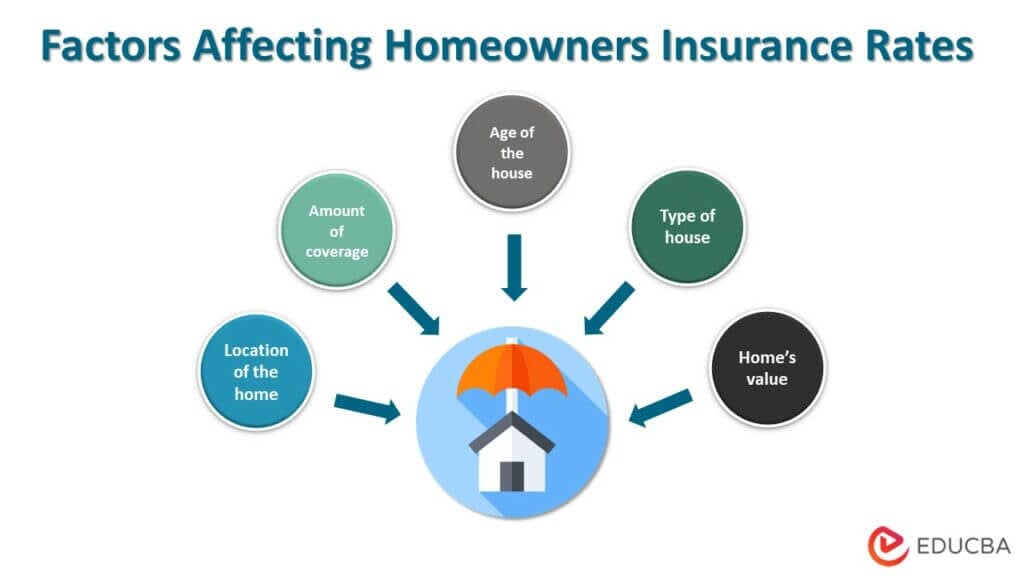

When it comes to home insurance eligibility, several factors play a significant role besides health conditions. These factors can impact the coverage options available to homeowners and the premiums they need to pay. Let’s explore some of the key factors that influence home insurance eligibility.

Location

Location is a crucial factor that can greatly influence home insurance eligibility. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods may face higher premiums or limited coverage options. Insurance companies assess the risk associated with the location of the property before offering coverage.

Home Age and Condition

The age and condition of the home also play a vital role in determining home insurance eligibility. Older homes or properties in poor condition may be considered riskier to insure, leading to higher premiums or potential eligibility issues. Regular maintenance and upgrades can help improve eligibility for insurance coverage.

Claims History

A homeowner’s claims history can impact their eligibility for home insurance. Multiple previous claims or a history of filing frequent claims can signal higher risk to insurance companies, potentially affecting eligibility or leading to increased premiums. Maintaining a claims-free record can positively impact eligibility.

Credit Score

Credit score is another factor that insurance companies often consider when determining home insurance eligibility. A higher credit score is typically associated with lower risk, leading to more favorable coverage options and premiums. Improving credit score can enhance eligibility for home insurance.

Lifestyle Choices

In addition to health conditions, lifestyle choices can also affect eligibility for home insurance. Factors such as smoking, owning certain dog breeds, or running a home-based business can impact insurance coverage. Insurance companies may consider these lifestyle choices as potential risks, influencing eligibility and premium rates.

Mitigating Health Condition Impact on Home Insurance

When it comes to health conditions affecting home insurance eligibility, there are strategies individuals can implement to mitigate the impact and improve their chances of securing coverage. By taking proactive steps and navigating the insurance application process effectively, individuals with health conditions can increase their likelihood of obtaining home insurance.

Tips for Improving Home Insurance Eligibility with Health Conditions

- Disclose all relevant health information: Provide accurate and detailed information about your health condition when applying for home insurance. Transparency is key to ensuring the insurance company has a clear understanding of your situation.

- Work with a specialized agent: Consider working with an insurance agent who specializes in finding coverage for individuals with health conditions. They can help navigate the process and connect you with insurance companies willing to provide coverage.

- Explore alternative insurance options: Research and explore alternative insurance options such as high-risk insurance pools or specialized coverage for individuals with pre-existing conditions.

- Improve overall health: Taking steps to improve your overall health, such as managing your condition effectively, can demonstrate to insurers that you are actively working towards better health outcomes.

Navigating the Insurance Application Process Successfully

- Prepare necessary documentation: Gather all relevant documents related to your health condition, medical history, and treatment plans to provide to the insurance company during the application process.

- Seek medical evaluations: Consider undergoing medical evaluations or assessments to provide current and accurate information about your health status to the insurance company.

- Communicate effectively: Keep open lines of communication with the insurance company or agent throughout the application process to address any questions or concerns they may have regarding your health condition.

- Review policy options: Take the time to review and compare different policy options to find coverage that meets your needs and provides adequate protection for your home.

Importance of Disclosing Health Conditions

When applying for home insurance, it is crucial to be transparent about any existing health conditions you may have. Failure to disclose relevant health information can have serious repercussions on your coverage and claims process.

Consequences of Not Disclosing Relevant Health Information

- Increased Risk: Non-disclosure can lead to inaccurate risk assessment by the insurance provider, potentially resulting in higher premiums or denial of coverage.

- Voided Policy: In extreme cases, failure to disclose health conditions could void your policy, leaving you without any coverage in case of a claim.

- Legal Issues: Intentional non-disclosure of health information can be considered insurance fraud, leading to legal consequences.

How Non-disclosure of Health Conditions Can Affect Coverage and Claims

- Claim Denial: If it is discovered that you withheld information about a health condition, your insurance provider may deny your claim, leaving you responsible for all associated expenses.

- Reduced Coverage: Non-disclosure can also result in reduced coverage for specific health-related incidents, leaving you financially vulnerable in case of an emergency.

- Policy Cancellation: In some cases, insurance companies may choose to cancel your policy altogether if they find out that you failed to disclose important health information.

Final Thoughts

In conclusion, understanding the nuances of health conditions and their impact on home insurance eligibility is key to making informed decisions. By disclosing relevant information and taking proactive steps, individuals can enhance their chances of obtaining the coverage they need.

Query Resolution

How do pre-existing health conditions affect home insurance eligibility?

Pre-existing health conditions can impact eligibility by influencing the risk assessment conducted by insurers. It may result in higher premiums or limited coverage options.

What are some common health conditions that may affect eligibility for home insurance?

Common health conditions that could impact eligibility include diabetes, heart disease, and certain mental health conditions.

Why is it important to disclose health conditions when applying for home insurance?

Disclosing health conditions is crucial as non-disclosure can lead to coverage denial or claim disputes in the future. It ensures transparency and accurate risk assessment.